Remember the thrill of launching your business? The endless possibilities, the burning ambition to turn your dream into reality? But as the initial excitement settles, new challenges emerge, and finances often take centre stage. Here arises the need for smart business budgeting.

According to the USA’s Bureau of Labor Statistics, roughly half of new businesses fail within the first five years of operation, and a staggering 20% fail within the first year. A major contributing factor to these unfortunate statistics is poor financial management. It’s a harsh reality, but one you can decisively overcome.

Imagine this: instead of constantly reacting to financial surprises, you have a clear vision of your business’s financial health. You know exactly where your money comes from and where it goes. You can confidently invest in growth opportunities and navigate unexpected setbacks with a prepared plan. This, my friend, is the power of smart business budgeting.

Smart business budgeting goes beyond the basic act of tracking expenses. It’s a strategic approach that empowers you to set clear financial goals, prioritise spending, and make informed decisions that fuel your business’s journey from a passionate project to a thriving profit powerhouse.

Throughout this blog, we’ll unpack the secrets of smart budgeting, providing actionable steps and practical tips to equip you with the tools you need to take control of your finances. By implementing some simple steps and viewing business finances from a slightly different perspective, you can transform your business from a financial rollercoaster into a well-oiled machine.

Why Smart Business Budgeting is Important

Steering a small business towards success requires navigating a complex financial landscape. Without a clear roadmap, unforeseen challenges can quickly derail your progress. Here’s the harsh reality: a lack of proper budgeting exposes your business to a multitude of financial pitfalls:

- Unpredictable Cash Flow: Fluctuating cash flow disrupts your ability to meet operational expenses and capitalize on growth opportunities. Imagine securing a lucrative new client, but lacking the necessary working capital to fulfill the order. Budgeting fosters financial foresight, allowing you to anticipate cash flow needs and make informed decisions.

- Missed Growth Opportunities: Imagine a brilliant product innovation that could revolutionize your market share. However, limited visibility into your financial resources hinders your ability to invest in this strategic initiative.

- Suboptimal Resource Allocation: Small, seemingly insignificant expenses can accumulate over time, silently draining your financial resources. Without a budget, these expenditures remain hidden, hindering your ability to optimize resource allocation.

How Budgeting Makes a Difference

Smart budgeting transcends the limitations of simple expense tracking. Here are the core principles that form the foundation of a robust smart budgeting system:

- Goal-Oriented Planning: Effective business strategies are driven by clearly defined goals. Smart budgeting starts with establishing measurable financial objectives, be it increasing revenue by a specific percentage or accumulating capital for a critical expansion project. Defining these goals provides a clear direction for your financial decision-making.

- Prioritized Spending: Not all expenditures have the same weight. Smart budgeting equips you with the analytical prowess to categorize expenses based on their impact on your business goals. This prioritization framework empowers you to allocate resources strategically, focusing investments on activities that deliver the highest return.

- Continuous Monitoring & Adaptation: Successful businesses constantly monitor their performance metrics. Smart budgeting allows you to track your spending in real-time, comparing it against your established plan. This financial vigilance enables you to identify areas for improvement and adapt your strategy as needed, ensuring your budget remains aligned with your evolving business objectives.

Building Your Smart Budget: A Step-by-Step Guide

Let’s face it, spreadsheets can be intimidating, and financial planning can feel overwhelming. However, all it takes is a clear plan and a willingness to take action, to build a smart budget.

To illustrate this process, I’m going to use an example I cooked up.

Let’s follow the journey of Sarah, owner of “Sarah’s Scones,” a local bakery. Sarah is passionate about baking, but lately, finances have been keeping her up at night. She wants to expand her menu and hire an additional baker, but uncertainties around her cash flow are holding her back.

Here’s how Sarah can build a smart budget to gain control of her finances and propel “Sarah’s Scones” towards delicious success:

Step 1: Goal Setting – Charting Your Financial Course

Any smart budget requires clearly defined goals. Sarah needs to ask herself: “What do I want to achieve financially?” Here are some examples of goals Sarah can set:

- Increase revenue by 20% within the next six months.

- Save enough capital to purchase a new oven within a year.

- Hire an additional baker by the end of the year.

By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, Sarah creates a roadmap for her financial journey.

Here are some other SMART goals you can create based on the type of business you’re managing:

For a Service-Based Business (e.g., Web Design):

- Convert 15% of website leads into paying clients within the next 2 months

- Decrease project completion time by 10% over the next 6 months

- Secure 2 new high-value clients within the next year

For a Retail Business (e.g., Clothing Store):

- Increase average customer order value by 10% in the next quarter

- Reduce inventory holding costs by 7% within 6 months

- Clear out 20% of old stock through a targeted sale by the end of the month

General Financial Goals:

- Increase net profit margin by 3% over the next year

- Build a cash reserve fund equal to 3 months of operating expenses within the next year

- Pay down outstanding business debt by 10% in the next quarter

Step 2: Categorizing Income & Expenses for Business Budgeting

Before Sarah can plan for the future, she needs to understand her current financial landscape. This involves meticulously listing all her income streams (e.g., scone sales, and catering orders) and categorizing her expenses.

Expenses can be divided into two main categories:

- Fixed Costs: These expenses remain constant each month, such as rent, utilities, and loan payments.

- Variable Costs: These expenses fluctuate based on business activity, like ingredients, packaging, and employee wages.

Sarah can leverage past bank statements and receipts to identify and categorize all her income and expenses. In general, here is why categorizing income and expenses is very important:

- Financial Clarity: Categorization groups similar income and expenses, giving you a clear picture of your financial landscape and spending patterns.

- Smarter Decisions: Analyzing categorized data allows you to make informed choices about resource allocation and identify potential cost-saving opportunities.

- Budgeting & Forecasting: Categorization is the backbone of creating realistic budgets, tracking spending against them, and building accurate financial forecasts.

- Cash Flow Management: Categorization helps you understand the timing of income and expenses, allowing for better cash flow management and planning for potential shortfalls.

Step 3: Choosing A Business Budgeting Tool

Now, Sarah needs a tool to organize her financial data. Here are two popular options:

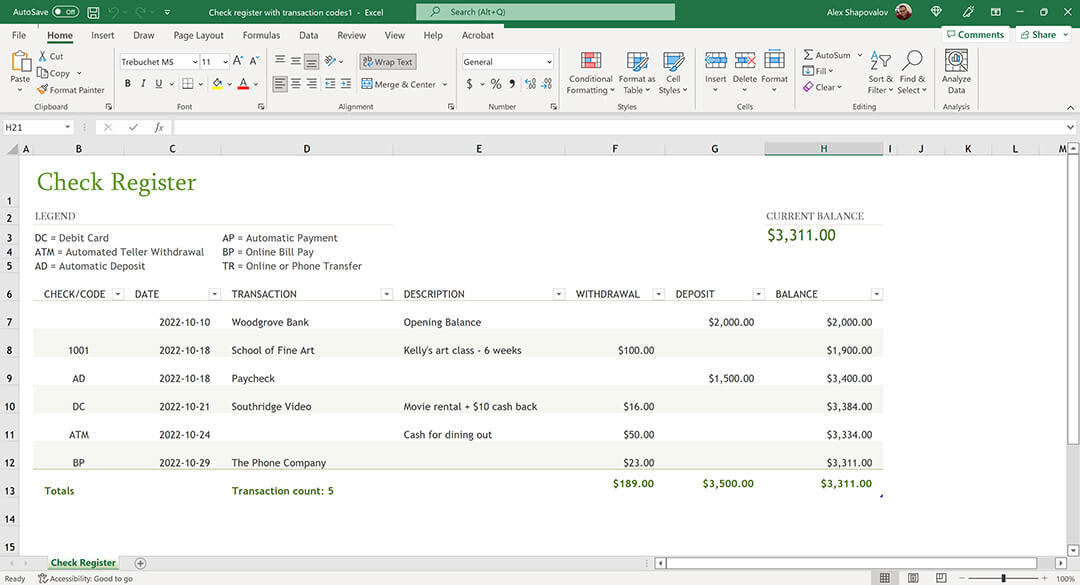

- Spreadsheets: Free and readily available, spreadsheets offer flexibility for customization. However, they can be time-consuming to maintain and prone to errors.

- Accounting Software: These user-friendly platforms automate many tasks and provide insightful reports. However, they often come with monthly subscriptions.

The best choice generally depends on your business budgeting experience and comfort level. Spreadsheets are a good starting point for smaller businesses (they’re also free) while accounting software can be a powerful tool for businesses with complex financial needs. If you are a beginner and want to move beyond spreadsheets, budgeting apps like Mint or You Need a Budget (YNAB) are perfect for you. They simplify expense tracking and provide basic budgeting features.

Step 4: Crafting a Realistic Budget

Armed with her income and expense categories, Sarah can now build her budget. Here are some key tips:

- Utilize Past Data: Historical sales figures and expense trends provide a solid foundation for projecting future income and spending.

- Industry Benchmarks: Researching industry averages for relevant expenses (e.g., ingredient costs) helps ensure realistic budget allocations.

- Leave Room for Maneuvering: Unexpected expenses are inevitable. Include a buffer in your budget to handle these surprises without derailing your financial plans.

By incorporating past data, industry benchmarks, and a contingency fund, Sarah can create a realistic and adaptable budget that reflects the true financial picture of her business.

Step 5: Tracking & Monitoring – The Secret Ingredient for Business Budgeting Success

Building a budget is just the first step. Another as important aspect is religiously tracking the actual income and expenses, and comparing it with your budget. In Sarah’s case, this allows her to:

- Identify areas where spending deviates from the plan.

- Adapt her budget in real-time to address unforeseen circumstances.

- Assess progress towards her financial goals.

Regular monitoring empowers Sarah to make data-driven decisions and ensure her budget remains a dynamic tool for financial growth, not a static document collecting dust on a shelf.

So, there you have it! We’ve unveiled the secrets of smart budgeting, transforming it from a boring spreadsheet into a powerful financial compass for your business journey.

By embracing smart budgeting, you gain control of your finances and unlock the potential for sustainable business growth. Imagine confidently investing in new opportunities, navigating unexpected challenges with a prepared plan, and witnessing your business flourish.

Did you know?

One of the major factors eating into the profitability of small businesses is the extent of transaction fees. Businesses in the U.S. earning $100k-$250k annually pay 2.9%-4.4% per transaction for payment processing! That’s a massive chunk of change. And you have the option of avoiding it completely.

At PaySprint, we’re offering a fast, secure payment processing solution with ZERO transaction fees. You read that right, and there’s no catch. We’re using a subscription-based model, so you pay a nominal amount every month, and use our services for unlimited transactions. With PaySprint, you can also accept payments offline AND through online gateways and links, and it requires no hardware investment. We truly believe that less is more. Make your business account today!

For more informative content on small businesses and e-commerce, click here! If you’re running an e-commerce store, we highly recommend you read these:

Why Every Small Business Needs a Growth Plan

Top 7 Decision-Making Tips for Managers

Scaling Your Business with PaySprint Wallet Balance Protection