-

5 Powerful Small Business Tips

This blog is about 5 powerful small business tips that can help your small business eclipse the competition and reach soaring heights. — Ever wake up in a cold sweat because you forgot to respond to a customer email, realized your social media posts are crickets chirping, and remembered that looming invoice needs to be…

-

Introducing the PaySprint Agency Program: Unlock New Earning Opportunities

Finding new streams of income is essential for staying competitive and financially robust in today’s fast-paced digital economy. At PaySprint, we understand the importance of diversification, which is why we are thrilled to introduce our Agency Program. This innovative initiative offers a unique opportunity for merchants to expand their services and earn additional income by…

-

Unlock More with PaySprint: Upgrade Your Personal Account Today

In today’s fast-paced world, managing finances efficiently is key to staying on top of your game. Whether you’re looking to send money effortlessly, pay bills, or access various financial tools, PaySprint offers tailored plans to meet your needs. Let’s dive into the different plans available for personal account users and explore the benefits of an…

-

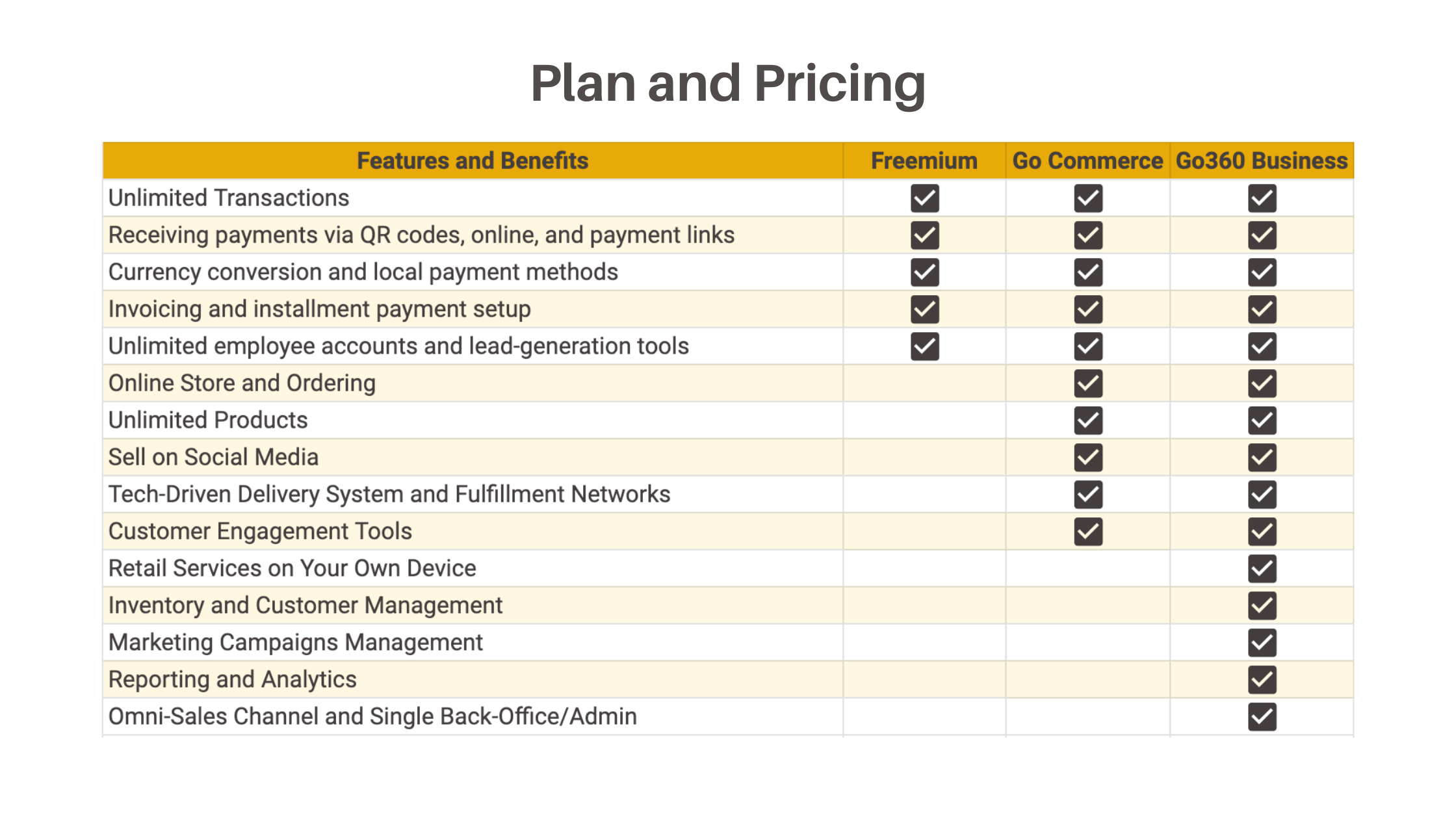

Benefits of Paid Plans for Merchants

In today’s competitive market, having the right tools and resources can make all the difference for businesses looking to grow and thrive. At PaySprint, we offer a range of plans designed to meet the needs of merchants at every stage of their journey. While our Freemium Plan provides essential tools at no cost, upgrading to…

-

The Importance of Account Verification with PaySprint

In today’s digital age, ensuring the security and authenticity of online transactions is paramount. At PaySprint, we prioritize the safety and trust of our users, which is why account verification is a crucial step in our onboarding process. Here’s why verifying your account with PaySprint is essential and how it benefits you. 1. Enhanced Security…

-

4 Common eCommerce Mistakes and How to Avoid Them

Have you ever gotten to the checkout stage of an online store, piled your dream items in the cart, then…poof! You’re gone, disappearing into the internet abyss without completing the purchase. Believe it or not, this happens millions of times a day – studies show that over 70% of online shopping carts are abandoned! While…

-

Boosting Your Online Sales: 4 eCommerce Marketing Strategies for Small Businesses

Imagine this: you walk into a bustling marketplace, but instead of customers, your store is filled with tumbleweeds. That’s the reality for many small businesses struggling to be seen online. A recent study by GE Capital Retail Bank found that a whopping 81% of consumers research products online before making a purchase. If your small…

-

User-Generated Content on Social Media: Harnessing the Power of Your Customers

Ever feel like your ads are getting lost in the social media shuffle? You’re not alone. Today’s consumers are bombarded with polished marketing messages, making it harder than ever to stand out. But what if you could tap into a marketing force that feels genuine, authentic, and resonates deeply with your audience? Enter the world…

-

Embracing Tech: Must-Have Technology for an Effective Retail Strategy

Remember the days of endless lines, frustrated customers searching for help, and outdated inventory systems? These are all things of the past now, partly because the retail world is undergoing a dramatic transformation, driven by powerful new technologies. Today’s tech-savvy shoppers expect a seamless experience, whether they’re browsing online or walking through your store doors.…

-

Ecommerce Strategy: How to Price Your Products for Profit

You launched your dream e-commerce store, stocked it with amazing products, and eagerly awaited the customer rush. But hold on! Before hitting that “publish” button, have you considered whether or not you’re using the right ecommerce strategy for pricing? Pricing isn’t just about attracting customers with low numbers. It’s a formula that you HAVE to…

PaySprint – Blog for Small Businesses