-

How Instant Access to Funds Helps Businesses Grow Faster

Growth doesn’t come from sales alone—it comes from how quickly revenue can be reinvested. Instant access to funds gives businesses a competitive edge that compounds over time. Faster Decisions, Better Outcomes When funds are available immediately, businesses can: Launch marketing campaigns without delays Take advantage of supplier discounts Respond quickly to customer demand Scale operations…

-

Cash Flow Is Oxygen: Why Waiting Days for Your Money Hurts Your Business.

Revenue may look good on paper, but cash flow determines whether a business survives. You can have strong sales and still struggle—simply because your money isn’t available when you need it. The Cash Flow Gap Most businesses face a recurring problem: Customers pay on time Funds are trapped in processing delays Expenses don’t wait This…

-

From Payment to Purchase in Seconds: How Wallet-Linked Debit Cards Change Everything

Accepting payments is only half the story.Being able to use those funds immediately is what truly empowers businesses. This is where wallet-linked debit cards redefine how payments work. The Traditional Limitation Most payment processors follow this path: Payment → Hold → Bank Transfer → Spend Even after funds are released, businesses still wait for bank…

-

Why Instant Access to Funds Is the New Standard in Online Payments

For years, businesses were taught to accept delayed access to their money as “normal.”A customer pays today, the processor holds the funds, and the business waits days before seeing its own cash. In today’s economy, that model is no longer acceptable. Modern businesses need speed, liquidity, and control—and that starts with instant access to funds.…

-

Why PaySprint Is Changing Online Payments With Instant Access to Funds

In today’s fast-moving business world, getting paid isn’t enough — how fast you can access and use your money matters just as much.That’s where PaySprint stands apart from traditional online payment processors. Unlike platforms that delay your money for days, PaySprint is built around instant access, real-time spending, and better cash-flow control for businesses and…

-

Your PaySprint Wallet Now Comes with a FREE Mastercard — Here’s What That Means for You

In today’s fast-moving digital economy, convenience, speed, and global access matter more than ever. That’s why we’re excited to announce a powerful upgrade to your PaySprint experience: 👉 Every PaySprint Wallet now comes with a FREE Mastercard. But what does that really mean for you? Let’s break it down. One Wallet. One Card. Total Freedom.…

-

Virtual Payment Terminal (VPT): Take Card Payments Over the Phone — Fast, Simple & Secure

In today’s fast-moving digital economy, service businesses need flexibility. Not every customer is standing in front of you. Not every transaction happens in person. And not every business wants to wait for invoices to be paid. That’s where the PaySprint Virtual Payment Terminal (VPT) becomes a game-changer. The VPT lets you take card payments over…

-

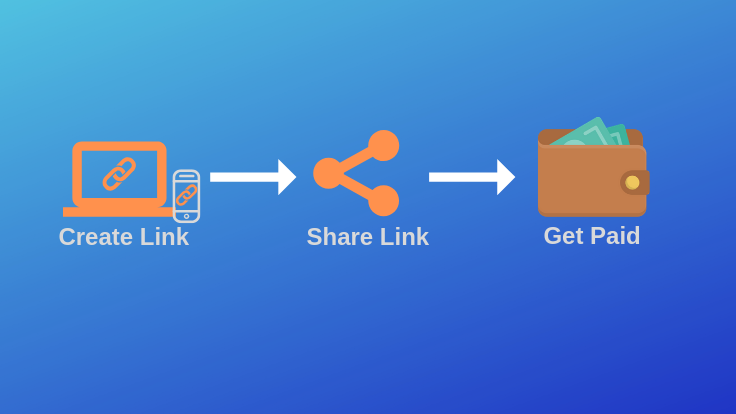

Pay Links: Request Payments Anytime, Anywhere

In today’s fast-paced digital world, customers expect payment options that are simple, flexible, and instant. That’s exactly what Pay Links deliver. Whether you’re running a remote service, selling online, or handling bookings over the phone, Pay Links make it effortless to collect payments—no hardware, no complications. What Are Pay Links? Pay Links are secure, auto-generated…

-

QR Code Payments: Zero Fees. Zero Hardware. Zero Stress.

In today’s fast-paced digital economy, businesses are moving away from expensive hardware and complicated payment systems. The world is going cashless — and QR payments are leading the revolution. Across Canada and globally, QR payment adoption has exploded. Why? Because it’s simple, secure, instant, and incredibly cost-effective. And with PaySprint, getting started takes seconds. We…

-

Customer Story: “How I Moved My Business Fully Cashless”

How a Local Merchant Eliminated Fraud, Lost Cash & Payment Delays Using PaySprint QR & Pay Links When Maria opened her small café in Brampton three years ago, she never imagined that handling cash would become one of her biggest challenges.Every day brought a new issue — missing cash at closing, counterfeit bills, long queues,…